Houston Texans legend Andre Johnson celebrated his election to the Pro Football Hall of a Fame with a lavish party at nightclub and restaurant Ciel on Sunday, April 7. Johnson will be the first Texan enshrined in the hall at a ceremony that will be held on August 3.

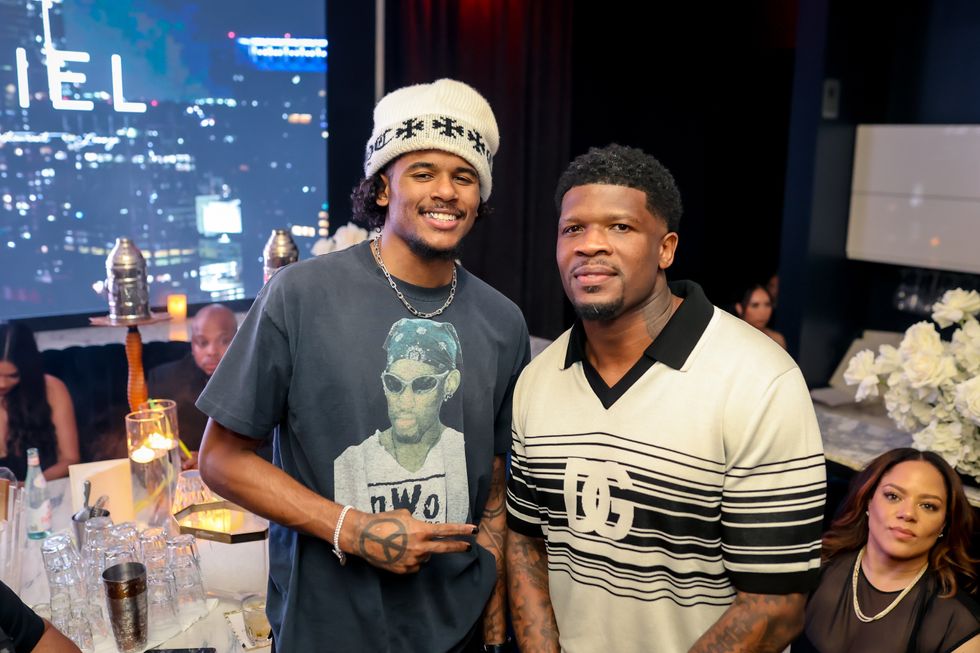

The event was packed with 250 of Johnson’s closest and most famous friends. These included Texans chair and CEO Cal McNair, fellow Hall of Famer Edgerrin James, Houston Rockets guard Jalen Green, and Houston Astros owners Jim and Whitney Crane. Other celebs in attendance included Houston hip hop legend Bun B, former Texans coach Gary Kubiak, and a number of former NFL stars including Adrian Peterson, Vonta Leach, Clinton Portis, Jonathan Joseph, Kareem Jackson, and Santana Dotson. Johnson’s mother Karen gave a speech about her son’s incredible career.

Ciel chef Will Ducante served a luxurious five-course meal that started with wagyu dumplings, wagyu tartare, tempura rock shrimp, and avocado salad. Guests dined on a surf and turf of lobster and Australian wagyu filets. For dessert, noted Houston bakery Who Made the Cake! prepared a towering six-layer red velvet construction designed by Nadine Moon. As an extra special touch, each layer was colored to coincide with the various teams Johnson has played with since high school.

The event was sponsored by Brown-Foreman, the illustrious distiller responsible for iconic brands like Jack Daniels, Old Forester, and Woodford Reserve. With the drinks flowing, the party was hosted by 97.9 The Box’s DJ Keisha Nicole, a close friend of Johnson’s.

Johnson also received a selection of gifts from his well-wishers. The Cranes presented him with a custom Astros Jersey featuring his name and the number 24 to mark his induction into the Class of 2024. Johnson’s friend Lynn Price gave him a vintage Chevrolet Corvette, painted with the Texans logo and a large 80 on the doors, his Houston Texans jersey number.

The party went deep into the early morning, according to a release, and featured a toast with premium Ace of Spades champagne.

Johnson was selected third by the Texans in the 2003 draft and played with the team for 12 seasons. In that time, he made his mark as one of the finest receivers in NFL history. He holds the Texans records for most career receptions, career receiving yards, career receiving touchdowns, receptions in a single season, receiving yards in a single season, seasons with 100+ receptions, and best receiving yards per game average.

The former wide receiver is also famous in the Houston area for his philanthropy. For Christmas 2012, he spent nearly $20,000 on presents for children in Child Protective Services, funded by his own Andre Johnson Foundation. Afterwards, he worked with the Houston Police Department as part of their Blue Santa program.

Other players who were announced as part of the Hall of Fame 2024 Class were Indianapolis Colts defensive lineman Dwight Freeney, Randy Gradishar of the Denver Broncos, football player turned pro-wrestler Steve “Mongo” McMichael, return specialist Devin Hester, defensive end Julius Peppers, and San Francisco 49ers linebacker Patrick Willis. The Houston Texans and Chicago Bears will begin the NFL pre-season by playing in the Hall of Fame Game on August 1.