Texas Tax Myths Shattered

Texas tax myths shattered: It's actually one of highest tax rates in U.S. — unless you're in the top 1 percent

If you're living in Texas and don't fall within the wealthiest one percent of residents, chances are you're paying some of the highest tax rates in the nation.

According to "Who Pays? A Distributional Analysis of the Tax Systems in All 50 States," a report recently released by the Institute on Taxation and Economic Policy (ITEP), Texas features one of the most regressive tax structures in the United States, coming in as the third worst behind only Washington and Florida.

Based on the index score, Texas has one of the most unfair tax systems for the average American.

When looking at the amount of taxes paid as a share of income earned, every state has a regressive tax system, meaning that poorer residents are taxed at higher rates than the wealthier ones. However, the difference in the effective tax rates between different income groups varies widely between each state.

Based on the index score — a ratio calculated from several factors to measure income inequality before and after taxes — Texas has one of the most unfair tax systems for the average American. These state tax rankings incorporate effective tax rates for the poorest 20 percent, the middle 60 percent and the top 1 percent, as well as ratios comparing these rates. A negative score on the ITEP index means state residents' incomes were less equal after taxes than they were before.

Texas garnered an ITEP index score of -8.5 percent, placing it in the bottom three of all 50 states for the most regressive tax systems.

The Lone Star State is one of only a few that doesn't levy personal income taxes. Although Texas collects a gross receipts tax — a tax on business transactions — it doesn't collect taxes on corporate profits. The oil and gas industry stimulates the economy and the state collects revenue in other ways, most specifically through sales and excise taxes. These kinds of consumption taxes accounted for nearly 32 percent of the state's revenue in 2012, which was the ninth highest in the U.S. for that fiscal year.

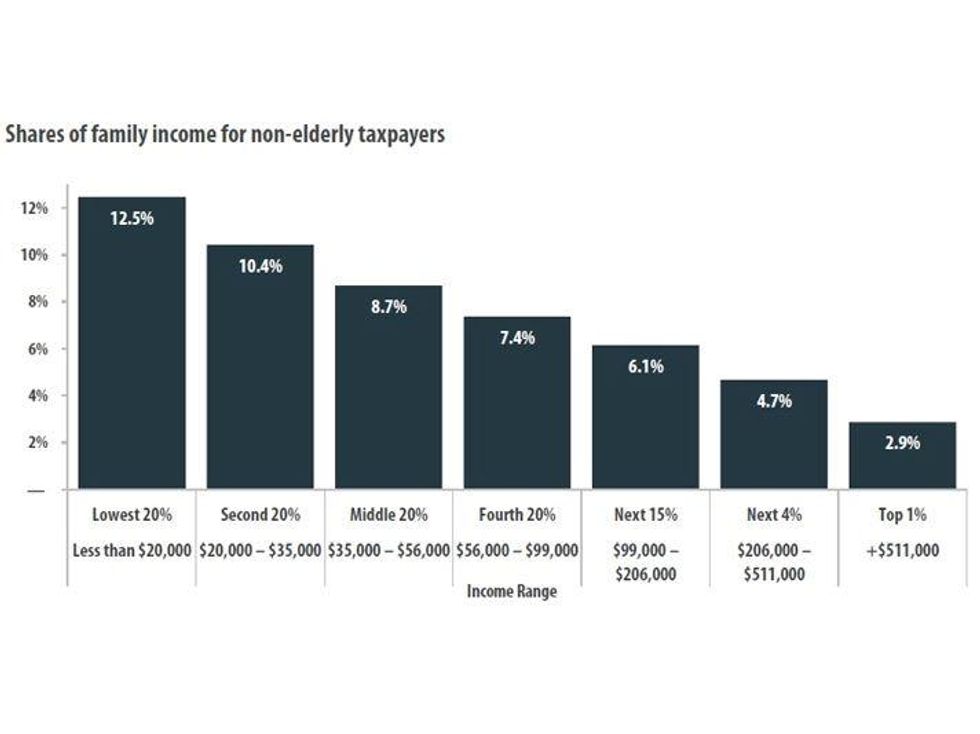

Additionally, Texas doesn't provide tax credits to low-income residents. As a result, the poorest 20 percent of families in Texas pay an effective state and local tax rate of 12.5 percent, which is the fifth highest in the nation. On the other hand, families falling into the wealthiest 1 percent pay just under 3 percent, the eighth lowest rate in the country.

In comparison, the poorest 20 percent of families in Washington pay nearly 17 percent of their income in state and local taxes — the highest rate in the nation — while the wealthiest 1 percent pay only 2.4 percent.

In Texas, the poorest 20 percent of families pay an effective state and local tax rate of 12.5 percent, which is the fifth highest in the nation.

The building at 4911 will be torn down for the new greenspace. Holland Lodge No. 1, A.F. & A.M./Facebook

The building at 4911 will be torn down for the new greenspace. Holland Lodge No. 1, A.F. & A.M./Facebook